Tuesday, December 22, 2009

Friday, December 11, 2009

Wednesday, November 25, 2009

Matt Simmons on FinancialSense Newshour

Matthew Simmons argues that conventional crude production peaked in May 2005 and that total world oil production will never go past 100 million barrels per day. He also shares his experience in some of the most promising renewable fuels (ammonia production), which could, in time, replace some of the lost production of liquid fuels.

Monday, November 23, 2009

Oil Drilling in Extreme Conditions

This video discusses how companies are drilling in very extreme weather conditions. Very insightful.

Thursday, November 19, 2009

Monday, November 16, 2009

Sunday, November 15, 2009

Saturday, November 14, 2009

The Prize Documentary

Sunday, November 8, 2009

Oil & Gas Exploration

Monday, October 26, 2009

Wednesday, October 14, 2009

Sunday, October 11, 2009

Friday, October 9, 2009

Wednesday, September 30, 2009

Sunday, September 27, 2009

Matthew Simmons' latest presentation

Marc Faber predicted the stock market rally in March

Sunday, September 20, 2009

Sunday, September 13, 2009

How to Trade Natural Gas, Crude Oil & Gold ETFs

How to Trade Natural Gas, Crude Oil & Gold ETFs

Chris Vermeulen

Chris@TheGoldAndOilGuy.com

www.GoldAndOilGuy.com

September 12th, 2009

How to trade hot commodities like natural gas, oil and gold - We should see big moves in the coming weeks as gas bottoms, and oil & gold breakout or breakdown. A lot of money is going to be exchanging hands quickly and the key is to be on the receiving end of things. Below are some charts showing where these commodities are trading.

How to Trade Gold – Weekly Chart

How I trade gold is relatively straight forward. I use a simple trading model which allows me to identify the down side risk for a potential gold trade. I also use the same model for trading oil, gas and silver.

Beyond finding good entry points, it is crucial to know when to take some profits off the table. The weekly gold chart clearly shows gold trading at a resistance level which means there are going to be more sellers than buyers, hence the reason it is called resistanceJ.

To trade gold I enter with my low risk entry points and sell half my position once I reach a resistance level. Today for example gold moved up into this long term resistance level and then started to head south. We took some profits off the table before gold dipped in the late afternoon for a healthy gain. Taking profits is a must or you’ll simply hold onto winning positions until they eventually turn into a loser.

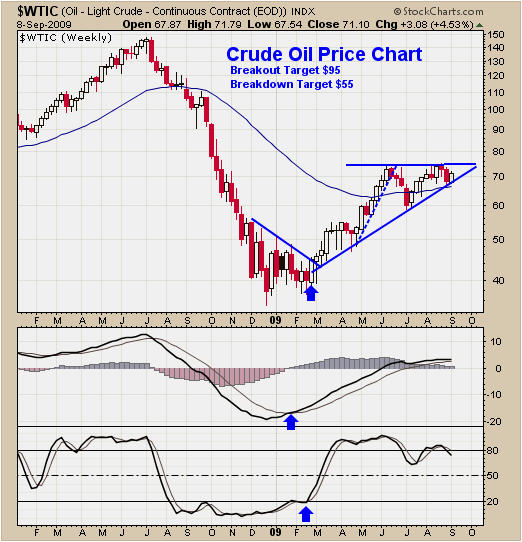

How to Trade Crude Oil – Weekly Chart

Trading crude oil is exciting because it moves much faster than gold. How to trade crude oil with low risk can be done by using my simple trading model which is a combination of indicators like momentum, support & resistance, volume, price patterns and media coverage. All these things combined allow for highly accurate trades with minimal down side risk.

Crude oil looks ready to make a big move. The odds are pointing to higher prices because oil has a multi month bullish price action and the falling US dollar helps increase the price of oil. I can see oil breakout and rally into the $95 per barrel level if things go that way in the coming weeks.

How to Trade Oil (USO Fund) – Weekly Chart

USO tracks similarly to the price of crude oil and it provides some great trades for both swing traders and day traders. I focus on trades that bounce off support with low downside risks, which occur on both the daily and weekly charts.

How to Trade Natural Gas – Weekly Chart

Natural gas is looking ready to bottom here. If you go back to the early 90’s the $2-3 range is a major support level. While I don’t generally try to pick bottoms, there are some signature price patterns and volume patterns that have proven to be very profitable for catching sharp bounces.

How to Trade Natural Gas – Daily Chart

The daily chart shows a perfect waterfall sell off with the price of natural gas dropping to a long term support level. This pattern combination shows panic selling which indicates a short term bottom is close.

The extreme panic selling and sharp decline in price, removes much of the down side risk. Scaling into a position over a few days, if the price continues to move lower, is important for this strategy to work its magic.

The black horizontal lines show my resistance levels for taking profits. If the price were to drop below $10 then I would exit the second half of the position to lock in the rest of the profit.

How to Trade Commodities Conclusion:

Trading commodities is very simple with all the ETF’s and funds available. The energy funds like oil and gas have some issues with following the prices of their underlying commodity but I do not find it a problem with my style of trading.

I would really like to know the entire story about what is going on with the oil and nat gas funds which have crazy contango issues??? Why do other commodity funds like GLD (gold bullion) and SLV (silver bullion) not have these issues?? Why can’t they make a fund which follows oil and gas properly? All I know is that there are a lot of dishonest people in the financial industry taking honest hard working peoples money.

If you would like receive my Free Weekly Trading Reports or my Real-Time Trading Signals for these funds please visit my website for more information: www.GoldAndOilGuy.com

Friday, September 11, 2009

Monday, September 7, 2009

Sunday, September 6, 2009

Wednesday, September 2, 2009

Wednesday, August 26, 2009

Wednesday, August 19, 2009

Energy workers oppose climate change measure

By TOM FOWLER Copyright 2009 Houston Chronicle

The message was clear to the 3,500 people attending the Energy Citizens rally in downtown Houston Tuesday: stop the climate change bill expected to come before the Senate this fall.

“The Senate should stand up and tear up this plan,” National Black Chamber of Commerce President Harry Alford said to a cheering crowd that was heavy with energy industry employees. The House of Representatives “wrote 1,100 pages of junk,” he said, referring to the climate change bill that passed that chamber this spring.

The event was the first of more than a dozen planned throughout the country in the next few weeks, pushed by a number of companies and business organizations but organized in Houston largely by the American Petroleum Institute. Several companies, including Woodlands-based Anadarko Petroleum Corp., bused employees to the event at the Verizon Wireless Theater, while others encouraged workers to attend.

Despite the emphasis on the effect of the legislation on the energy industry, none of the speakers came from that field.

The keynote speaker was Drayton McLane, owner of the Houston Astros and chairman of the McLane Group, which operates food distribution enterprises and military services. The master of ceremonies, Bill Bailey, is best known for his work as announcer at the Houston Livestock Show & Rodeo.

McLane said low-cost fuel helped build the American economy and noted how improvements in production and distribution had lowered the share of household budgets that go into food.

“We need to preserve this way of life,” McLane said.

None of the speakers mentioned political parties or the debate over whether humans are responsible for climate change, a talking point for many in the industry.

They also avoided details about the bill other than what they see as its potential consequences for consumers and the energy industry.

Among other things, it would set caps on greenhouse gas emissions by refiners, power plants and others and require companies to purchase emission permits.

Bailey warned that if the bill pushed gasoline prices up, it could force communities to make cuts in police and fire protection. Alford argued it would endanger jobs.

Perry Courville, an employee of oil field services giant Halliburton Co., said he was against the bill long before the rally but that the strong turnout was reaffirming.

John Torgersen, an employee of ConocoPhillips, said he generally doesn't get involved in politics but that the more he learned about the bill, the more he felt that it would affect his work.

“I was feeling like someone drew a little circle around me with the bill and said, ‘Let's go after this guy over here,' ” Torgersen said.

Anyone looking for a debate on the issues found little outlet at the rally.

David Bowdle, who stood on the sidewalk in front of the event holding a sign reading “Global Warming is a Hoax,” said organizers didn't allow him in.

Neither was a small group from Public Citizen who handed out copies of a study that said the bill will create jobs.

Matthew Tejada, executive director of the Galveston-Houston Association for Smog Prevention, did manage to get in. His summary of the event's message: “Stall, block, delay and don't change.”

“It's a knee-jerk rejection that panders to people's most common fears of losing jobs and costing more money,” Tejada said. “What's happened in the past with new laws is we adjust, develop new technologies, absorb and lower the costs, and then move on.”

The rally's message, he said, “will serve neither the future of this city nor the future of this country very well.”

tom.fowler@chron.com

Sunday, August 9, 2009

Saturday, August 8, 2009

Sunday, August 2, 2009

Sunday, July 26, 2009

Monday, July 20, 2009

ConocoPhillips CEO talks to Bloomberg

Jim recently gave an excellent speech in Detroit were he discusses the world's energy infrastructure. Here's his speech

Chevron CEO's Energy Outlook

Lee Raymond Interview - 2007

Sunday, July 19, 2009

Marc Faber criticizes the Fed for having caused all bubbles in the US economy. First after the stock market bubble of the 1990's, the Fed massively increased the money supply in 2001, and kept interest rates at 1% almost three years after the US economy recovered. These irresponsible actions created the housing and credit bubble in the early part of the decade.

Not only that, but he mentions that employment in the US in June was about the same number of people employed in the year 2000! In other words, all the employment gains since 2000 have been lost in this depression. If unemployment were properly measured, the unemployment rate would be 16%. See the chart below:

Faber also discusses that not only was the 2002 recovery a jobless recovery, but that quality of jobs has declined. The US has changed high-paying, high-value adding manufacturing jobs for service and retail jobs.

Faber also discusses that not only was the 2002 recovery a jobless recovery, but that quality of jobs has declined. The US has changed high-paying, high-value adding manufacturing jobs for service and retail jobs.The US dollar has lost 95% of its value since the Fed was founded in 1913 (in other words, something that cost 5 cents in 1913, today costs more than a $1) Faber says that the other 95% of purchasing power loss will take only 10 years.

Sunday, July 12, 2009

No New Energy Taxes!

Moreover, one of the few industries that is doing OK in this depression is the O&G industry. If these new taxes pass, million of jobs could be at risk. Just here in Texas, the Oil & Gas industry indirectly supports 32.3% of all jobs in the state (2.8 million jobs)

To learn more, please visit this website.

Sunday, July 5, 2009

Commodity Bubble Revisited

In the future, whenever you hear someone call the commodity bull market a bubble, simply tell them the following:

- Show me the bubble in inventories!

- Show me the bubble in capital expenditures excluding inflation!

- Show me the bubble in employment!

- Show me the bubble in valuation multiples!

- Continue to read more

10 Reasons Why Now Is A Great Time To Invest In The Energy Sector

Editor, Powers Energy Investor

July 2, 2009

Reason 1: Low Valuations

The 74% drop in the price of crude and a similar drop in the price of natural gas that began in middle of 2008 and continued into early 2009 devastated valuations in the oil and gas sector.'

Reason 2: Peak Oil

Peak Oil means that the world will no longer be able to grow production on a year-over-year basis irrespective of price or new technology.

Reason 3: Peak Natural Gas

According to the US Department of Energy, domestic natural gas production peaked in 2001 19.61 trillion cubic feet (tcf) from 373,304 producing wells.

Natural gas directed drilling on a scale never seen before caused US production to reach a second peak of 20.57 tcf in 2008. However, this second peak is not only unsustainable, but it has set the stage for an enormous collapse in US gas production and a spike in prices in the second half of 2009 or early 2010.

Reason 4: Terrible Investor Sentiment

After a cathartic selling of everything energy in the second half of 2008 and into the first quarter of 2009, many industry insiders and investors have reached a level of despair that has rarely been seen before.

Click here to see the other 6 reasons

Hyperinflation Nation Movie

Wednesday, May 13, 2009

Tuesday, May 12, 2009

Sunday, May 3, 2009

Put your money in Agricultural Commodities

"Commodities are the only place where fundamentals have improved after this crisis" says Jim Rogers. He argues for commodities, especially agricultural commodities. Prices on a historic basis are extremely low. Not only that, but because of this crisis, farmers are not getting credit for equipment, fertilizer and other things. Moreover, we have among the lowest food inventories in history, while demand has constantly grown. Take a look at this news story regarding sugar prices.

The Fed will continue to print Money

Marc Faber argues about the strong bear market rally, despite all bad news. He says that although things have fundamentally deteriorated, the current money printing by Fed may lead to a rally in the stock market. The more the economy worsens, the more money Ben Bernanke will create out of thin air. Look below

Thursday, April 23, 2009

Matthew Simmons' Latest Presentation

Saturday, April 18, 2009

Matthew Simmons - March 2009

Matthew Simmons discusses the current price of oil. He points the disconnect between "paper barrels" (financial trading) vs. "wet barrels".

Between 1998 and 2008, global oil demand increased by 12.6MMBD while crude oil production went up only 7.5MMBLD (the difference was picked by NGL's, refinery gains, synthetic crude and crude inventory liquidations)

Wednesday, April 15, 2009

Saturday, April 11, 2009

Be Careful What You Wish For

Apart from the obvious financial distress that the current economic crisis has inflicted on most Americans, perhaps one of the more irksome byproducts of the meltdown has been the inescapability of clueless economic blather. It’s bad enough when so-called economists serve up the same Keynesian nonsense that has led us down the current cul-de-sac in the first place. At least those people have some incidental knowledge, however deeply flawed, of basic economic concepts. It’s far worse when political pundits, whose understanding of economics typically comes from Treasury Department talking points, hold forth as if they really know what is going on.

Last weekend I happened to watch the McLaughlin Group, a mainstay of Sunday morning political programs, which included a discussion that typified the lack of economic common sense that is so pervasive in our country. The program’s anchor John McLaughlin, undoubtedly an expert in political maneuvering and Washington horse-trading, offered viewers his assessment of the global economic landscape. McLaughlin identified China, Germany, and Japan as being prime offenders in the global economic meltdown. Their “offense” was that they ran persistent trade surpluses, had savings rates that were “far too high” and consumption rates that were “far too low”. McLaughlin identified these sins as responsible for the global economic imbalances. He urged the governments of those countries to adopt policies that would encourage their consumers to borrow and spend more. Exactly which school of economic thought informed his assessment is not entirely clear.

In the first place, if the creditor nations of the world actually follow Mr. McLaughlin’s advice and become borrowers themselves, from just where does Mr. McLaughlin believe the money will come? These countries already lend to America. Does he think that they also have enough leftover to lend to themselves? Does he believe that America, which is tens of trillions of dollars in debt, has enough excess savings to lend? Perhaps he’s eyeing the Martians’ accumulated savings? The point is: the entire world cannot borrow at the same time. Someone has to do the lending. The only reason Americans are able to borrow so much is that those “offending nations” are loaning us the money.

Mr. McLaughlin apparently believes that if those countries simply adopted policies to encourage more consumption, America would then be able to export more products. Just what American-made products does he expect the Chinese to buy? If China did spend more, which they ultimately will, they would simply buy more of their own products that they currently ship to us. After all, if Americans are not buying American-made products, why would the Chinese? In most cases, it’s not that consumers do not want to buy American products it’s just that there are so few American-made products that are competitive in the global marketplace.

One guest on the panel did try to correct Mr. McLaughlin by suggesting that Americans needed to save more and spend less, but he was quickly shot down. Why should we spend less, McLaughlin snapped, when they could shoulder some of the burden by spending more? The inference here is that we are doing our part by lugging home shopping carts full of consumer goods, while they are getting off easy by spending their days in muggy factories making the goods!

What he fails to understand is that nothing can be bought that is not first produced. We cannot all just decide to spend our troubles away. It is only because the “offending nations” are producing surplus goods (meaning more goods than they are themselves consuming) that those goods are available to Americans. In McLaughlin’s America, and indeed Obama’s, we would all be standing around empty shelves with wheelbarrows full of worthless cash.

If the creditor countries are indeed the offenders, it is only in the sense that they have enabled us to live beyond our means and have facilitated the growth of our phony economy. However if they do as Mr. McLaughlin suggests, the immediate impact on the American economy will be much different than what he expects: the dollar will collapse, both consumer prices and interest rates will rise sharply, and the current recession will deepen. Rather than holding us back, foreign creditors have actually been propping us up. As for Mr. McLaughlin, he should stick to his strong suit: the dissection of political posturing. To presume a level of economic understanding by listening to self-interested politicians and academics is to invite catastrophe.

Sunday, April 5, 2009

Instability & Depletion Add Uncertainty to Energy Sector

by Joseph Dancy, LSGI Advisors, Inc. | April 3, 2009

Energy use correlates closely with economic growth. Last month the World Bank forecast the global economy will likely shrink for the first time since World War II. International trade will decline by the most in 80 years according to the report, a stark trend in an economy that has been ‘globalized’ over the last several decades.

Crude oil exporters on the list of those at high risk of political instability account for nearly 26 million barrels per day of production—a very high percentage of global petroleum output. Keep in mind globally we use roughly 85 million barrels of liquids per day, which is near the global capacity to produce.

With current crude oil prices around $45 substantial volumes of production will be shut-in or not developed according to analysts. Stanford Bernstein forecasts U.S. crude oil production will decline by 400,000 barrels per day next year if current crude oil prices remain in place.

Depletion, which runs anywhere from 4% a year upward (note Cantarell’s nearly 40% decline rate referenced above), reductions in capital expenditures, depressed energy prices, limitations imposed by the global credit crunch, nationalized oil fields, all will adversely impact future production levels.

Crude oil futures remain in ‘contango’ – a situation where the value in the future is much higher then at the present. Some analysts claim this is bullish for the commodity, an indication that the supply and demand for oil remains bullish. Companies can use this curve to hedge production from current reserves in the ground (chart courtesy Financial Times).